Monad: The New L1

On The Block…chain

Monad is one of the most ambitious infrastructure bets of this cycle. A new L1 that questions the tradeoff: that widespread decentralization comes with slower speeds.

Other chains proved speed was possible, but with caveats. Faster performance came at a cost. You gained efficiency, but required more centralized control to achieve it, losing some of what made crypto meaningful in the first place.

Monad’s bet is that this tradeoff was never inevitable, that principles and usability don’t have to be opposites.

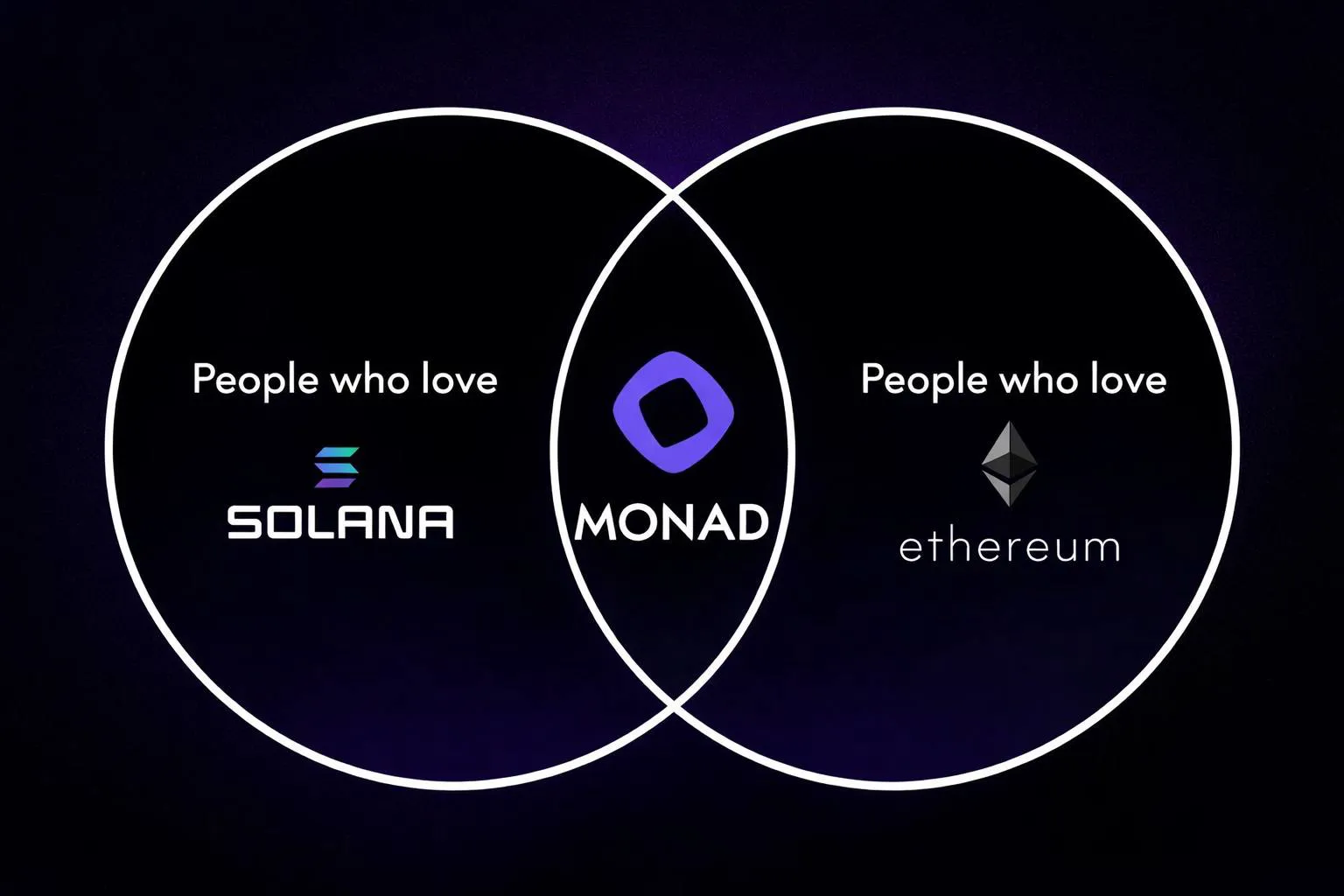

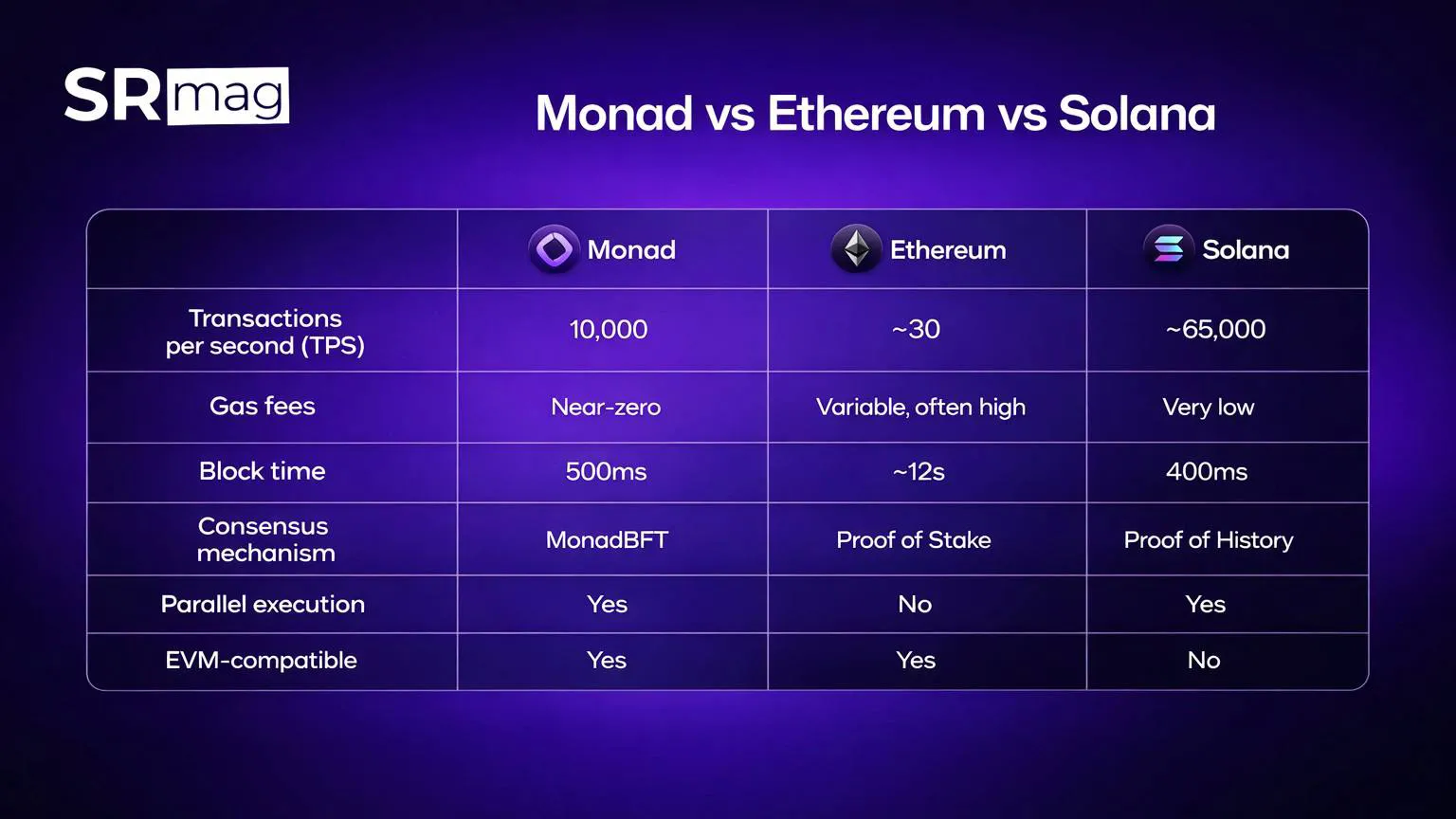

For years, crypto has lived with a forced compromise. If you wanted an Ethereum-style ecosystem, you accepted high fees, long waiting times, and a user experience that lagged far behind modern software expectations. If you wanted speed, you had to leave the EVM entirely.

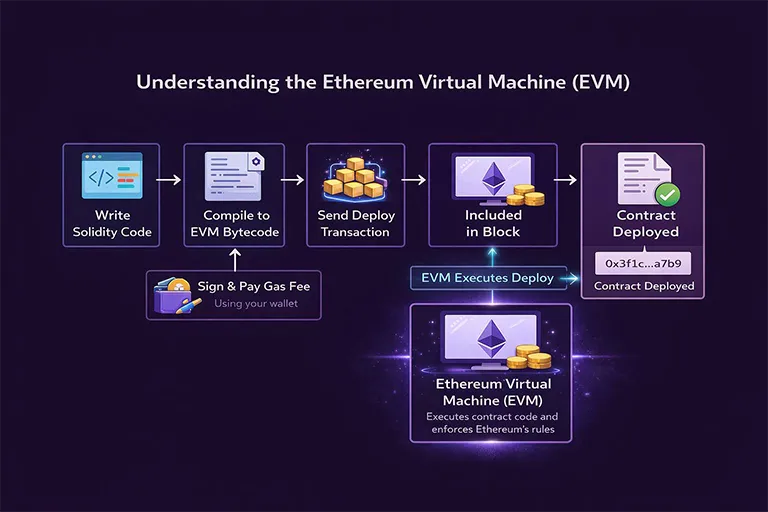

The EVM is Ethereum’s execution engine, the shared environment where smart contracts run and where most of crypto’s major applications were first built. It’s powerful, but it was designed in a very different era, when output and latency weren’t the primary concerns.

So if you wanted speed, you didn’t just change chains, you left that environment altogether. It wasn’t “Ethereum, but faster.” It was a completely different execution model. You weren’t upgrading Ethereum; you were stepping into a different style of computation. One that usually sacrificed decentralization.

Monad’s idea is simple: keep the EVM, keep the ecosystem, and make it fast enough to get the best of both worlds, speed and decentralization.

That goal matters more than it sounds. Because the real bottleneck in crypto today isn’t ideas. It’s the friction. Waiting. Gas spikes. Liquidity fragmented across layers. Apps that technically work, but feel clunky to use. Monad is aimed directly at that frustration, the sense that blockchains should already feel more advanced than this.

Monad was built by engineers with backgrounds in high performance systems, people used to environments where latency is treated as a failure. So instead of designing a brand new smart contract machine or asking developers to relearn everything, they made a harder choice: rebuild the engine under the EVM without changing the rules of the game.

That decision shaped everything.

On most blockchains, transactions move through a single line.

Each transaction waits its turn, gets fully processed, and only then does the chain move forward. If one transaction is slow or expensive to compute, everything behind it waits. Speed is limited by the slowest step in the line.

Monad changes that flow.

Instead of waiting for every transaction to fully finish before moving on, Monad locks in the order of transactions first. Once that order is agreed on, the chain doesn’t stop. It keeps advancing while transactions are processed in parallel in the background. Simple transactions finish quickly, heavier ones take longer, but they no longer block progress for everyone else.

This single change unlocks efficiencies earlier chains could only dream of. The network can keep producing blocks continuously. Lightweight activity doesn’t get trapped behind heavyweight computation. Work that doesn’t interfere with other work can happen at the same time instead of one after another.

What matters is that none of the rules change. From the outside, everything behaves exactly like Ethereum. Smart contracts work the same way. Transactions resolve in a clear, fixed order. You get the same results, just without the system constantly stopping to catch its breath.

And from a developer’s point of view, everything learned building on Ethereum carries over.

That’s the thing that makes Monad interesting: it doesn’t feel radical on the surface, but it’s radical underneath. It looks familiar, but it behaves very differently.

Ethereum won the developer war. But that victory didn’t solve usability at scale. Layer-2s helped, but they also introduced complexity: bridges, fragmented liquidity, different environments, different assumptions. The system works, but it’s fragile and mentally expensive.

Monad’s response is to collapse that complexity back into a single chain. It isn’t trying to replace Ethereum. It’s an attempt at its evolution, toward what crypto was meant to be: fast, decentralized, and scalable.

For a long time, Monad was just a “serious chain people talk about.” Years of development. Testnets. Benchmarks. High expectations. Then came the transition every infrastructure project has to survive, going from promise to reality.

This is the phase Monad is now entering, the phase where it has to earn its reputation.

If Monad succeeds, it won’t just be another chain in the list. It will be a signal that Ethereum compatibility doesn’t have to mean Ethereum era performance. That the EVM can remain the default language of crypto without forcing everything to run in slow motion.

But none of this is guaranteed.

There are real risks. Adoption is not automatic. Liquidity and users are volatile, attention is hard to maintain as competing scaling paths continue to improve. Running a truly high output chain introduces long term challenges around growth and decentralization pressure. And great engineering does not magically produce great ecosystems.

Monad could stall. It could end up technically impressive but culturally marginal. That’s the reality of infrastructure bets.

Still, its existence matters. Because it represents a refusal to accept limits.

Monad isn’t selling a dream. It’s attempting to raise the baseline, to make fast, cheap, and familiar the default instead of the exception.

Monad is currently sitting at a market cap of $200M. Whether it becomes a dominant execution layer or simply forces the rest of the ecosystem to improve, its impact will be measured the same way all good infrastructure is measured: not by how loudly it announces itself, but by how quietly everything else starts to work better.